2025 Global Film Blowing Machine Market Analysis

2025-05-20According to recent market research, the global blown film machine industry will maintain steady growth from 2024 to 2025, driven by technological advancements and sustainability demands. Key trends include:

1.Structural Demand Growth

Expanding applications in packaging, food, medical, and renewable energy sectors—especially for biodegradable and functional films—are fueling market growth. Emerging economies (e.g., Southeast Asia, Africa) are pivotal demand drivers.

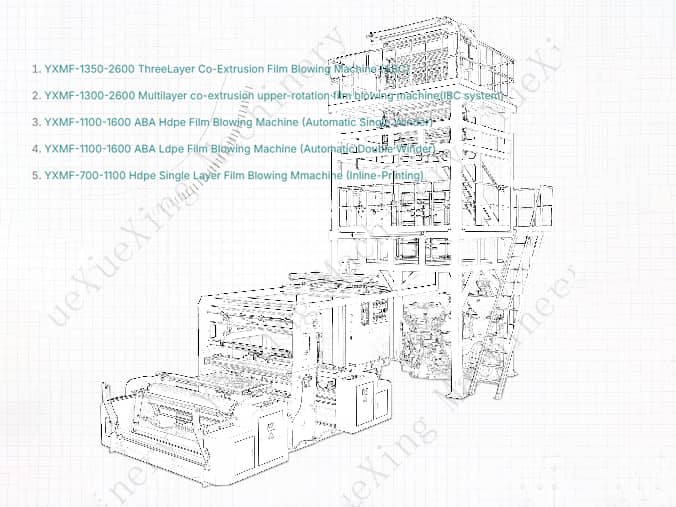

2.Technology Leapfrogging

AI and IoT-enabled machines dominate, featuring remote diagnostics, self-optimizing processes, and predictive maintenance. Modular designs and multi-layer co-extrusion capabilities set new benchmarks.

3.Mature Markets Lead Innovation

North America and Europe retain dominance in high-end markets, spurred by circular economy policies. Carbon-neutral production equipment gains traction under regulations like CBAM.

4.Market Consolidation Intensifies

Top players leverage M&A to strengthen R&D and supply chains, while niche specialists focus on ultrathin films and bio-based material processing.

5.ESG Reshapes Priorities

Energy-efficient models (30%+ reduction) and recycled-material compatibility are mandatory. EU’s CBAM forces exporters to adopt low-carbon technologies.

6.Asia-Pacific as Production Hub

China, India, and Vietnam attract FDI with localized manufacturing. RCEP enhances regional supply chain integration.

7.Circular Economy Opportunities

Chemical recycling advancements demand machines capable of processing high recycled content, driving innovations in filtration and melt homogenization.

8.Smart Manufacturing Ubiquity

Digital twins and 5G enable fully automated lines, with 40% of global machines expected to connect to IIoT platforms by 2025.

9.Supply Chain Resilience

Nearshoring (e.g., Mexican PP resin) and AI-driven inventory systems mitigate geopolitical and climate risks.

Outlook: The 2025 market will prioritize "Tech+Green" synergies, with compliance innovation and localized supply chains as critical success factors.